$500 Million Raised, but Was It Fair?

Plasma’s highly anticipated ICO (Initial Coin Offering) for its XPL token closed its vaults after raising $500 million from over 1,100 depositors.

The event, which marked a dizzying display of capital deployment and gas wars, has raised concerns among community members.

Plasma ICO Raises $500 Million Amid Whale Frenzy, Expecting $1–2 Billion Unlock?

While the token has not yet been launched, expectations are already swelling that the final unlock could bring in $1 billion to $2 billion, if not more.

“We have reached our deposit cap of $500 million. We are thrilled that 1,100+ wallets participated, with a median deposit amount of ~$35,000. Trillions,” Plasma announced.

Amid the headlines and hype, however, a deeper story is emerging. Concerns extend from whale domination and insider access to a growing sense that token launches are increasingly becoming gated events for the crypto elite.

The numbers show that only a handful of wallets accounted for outsized allocations. More specifically, the top three contributors alone deployed over $100 million collectively.

Perhaps more shocking, one user reportedly paid 39 ETH (approximately $104,871 at current rates of $2,689) in gas fees, which secured them a $10 million USDC allocation.

“This guy spent 100k in gas (230,000 Gwei) to get his deposit in for Plasma,” wrote MonaMoon, the founder of the Duck Frens NFT project.

This illustrates the intensity of FOMO and the lengths participants were willing to go to for early access. Notwithstanding, the frenzy has come at a reputational cost. With whales taking the lion’s share, many are calling this launch anything but fair.

“…it’s an obvious skip for the community…Only 100 wallets with $50 million each… these wallets alone will create an oversubscription of 100x… unfortunately, it’s not a fair launch, even though the price is very attractive,” warned an X user before the raise closed.

Despite offering just 10% of the total XPL token supply in the public sale at a $500 million FDV (fully diluted valuation), retail users were effectively pushed to the sidelines. They will likely only get in later, at 10x to 16x the price.

Critics Slam Plasma’s Tech and Tokenomics- ICO Was a Lockout, Not a Launch

This sharp disparity has some dubbing it a “whale sale,” rather than a launch accessible to the broader community. Further, there may be more than just bad optics at play. Crypto trader Hanzo raised serious red flags, suggesting possible coordinated insider behavior.

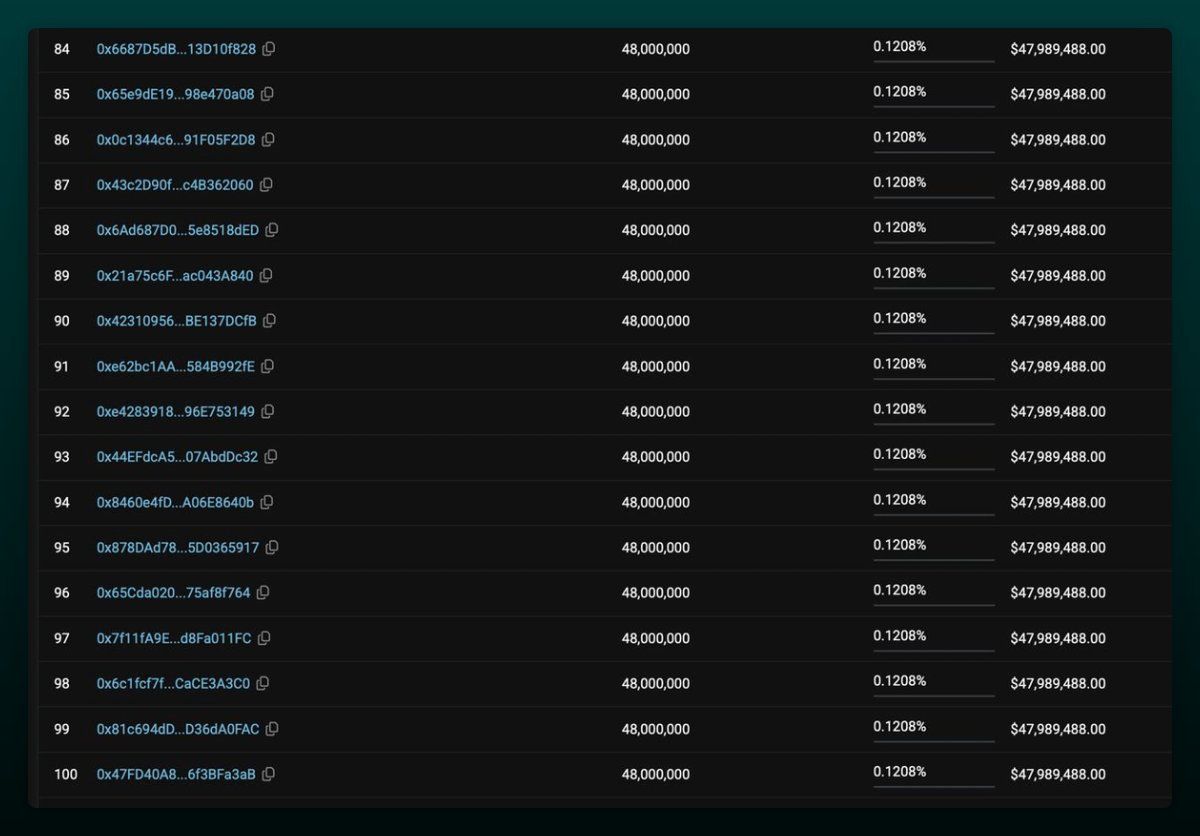

Hanzo calls out over 100 wallets, each receiving 48 million USDC, before the token even launched, highlighting that some of these wallets approved token interactions before the token contract went public.

“That means insiders had early access to mint and trade. This wasn’t a surprise launch — it was a private party. Retail wasn’t invited,” he claimed.

The mechanics of the raise also raise questions. Hosted on Sonar/Echo, dubbed by some as “the CoinList of this cycle,” a time-weighted share of vault deposits determined plasma’s deposit period.

Participants had to lock stablecoins on Ethereum, with a minimum 40-day lockup. However, with the deposit cap abruptly raised to $500 million and filled almost instantly, many users were left wondering whether this was ever meant to be an open opportunity.

Even the technology underpinning Plasma has not escaped scrutiny. A user broke down the chain’s architecture and found it lacking.

“Plasma is another L1 chain… It uses a ‘classic’ pBFT consensus layer, with Proof-of-Stake… and Bitcoin as ‘settlement’ by simply publishing state differences… It looks a lot like many alt-L1 EVM forks… It surfs on the Bitcoin “side-chain” marketing campaign and is pushed by influencors.. but I am not convinced at all,” the user noted.

In his view, Plasma’s use of influencers and Bitcoin branding is more marketing veneer than technical substance.

Still, not everyone agrees. Zaheer from SplitCapital praised the distribution, noting a broad holder distribution with over 1,100 wallets and only one wallet holding $50 million.

“All things considered insanely good distribution of holders for Plasma at $500m total size of deposit. Seeing a ton of folks with smaller amounts on here and only one entity with $50m in a wallet. Well done,” he stated in a post.

According to Zaheer, this contrasts with the typical whale-dominated ICOs and suggests a more inclusive allocation strategy.

Plasma’s ICO serves as a mirror to today’s market mechanics, where speed, size, and for some, connections, often matter more than innovation or accessibility.

Whether Plasma becomes a foundational chain or another cautionary tale will depend on the unlock numbers and how its ecosystem fairs beyond the ICO hype.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.